Accelerate your data science career with Fractal’s certification! Gain job-ready AI, analytics, and machine learning skills to land top roles. Start today!

What Is Price Elasticity

Data Science and business are becoming more and more intertwined.

Data scientists, data engineers, as well as BI analysts’ work is already crucial to projects’ success in numerous industries.

Here’ why: Because they help companies by analyzing data and gaining insight, which can be used for product development, and ultimately increase their ROI.

So, in this article, we’ll introduce to you to a fundamental concept in economics and marketing.

You guessed it – price elasticity.

We’ll explore its relationship to data science and purchase analytics.

What’s more, we’ll discuss three main areas where it plays a key role: purchase probability, brand choice, and purchase quantity.

But first things first:

[ufwp id=”2347360″]

What is Price Elasticity?

In the broadest terms possible, it measures how purchasing behavior changes when the price changes.

Let me elaborate a bit.

For instance, let’s assume a bottle of Coca-Cola costs \$1. If the price increases to \$2, many people would stop buying Cola, as it would be too expensive. On the other hand, if the price decreases to 10 cents, a lot more people are going to start purchasing Coca-Cola.

The measure we use to quantify this phenomenon is called: ‘price elasticity of Coca-Cola demand’ or ‘price elasticity’ in short.

Now, as you can imagine, if we assume that a Pepsi also costs $1 and Coca-Cola cuts its prices to 10 cents, then most of the people that used to buy Pepsi, would immediately transfer to coke.

And vice versa – if the price of coke increased to $2, instead, people would likely stop buying coke and turn to Pepsi. That points to another important phenomenon – ‘price elasticity of Coca-Cola demand with respect to the price of Pepsi’, or the so-called ‘cross-price elasticity’.

I’ll break this down to you.

In the first case, where we measure the elasticity of Cola with respect to itself only, we call that own-price elasticity, price elasticity of Coca-Cola demand, or simply price elasticity of Coca-Cola.

However, in the second case, where we’ve got 2 products, we must say the whole name: ‘price elasticity of Coca-Cola demand with respect to the price of Pepsi’, in order to be sure that there will be no confusion.

Alright. Now that we have an idea about what price elasticity is, let’s discuss it in economics terms.

[ufwp id=”2347360″]

What’s the Role of Price Elasticity in Economics?

Price elasticity stems from the basic economic law of supply and demand.

The cheaper the product – the higher the demand. The more expensive the product, the lower the demand. Simple as that.

It is extremely important for businesses though, because there is this sweet spot that maximizes revenue. Since revenue is equal to the ‘price’ times ‘units sold’, we can use this price elasticity concept to find the point at which ‘price’ times ‘units sold’ is optimal.

Okay, but how does this look in mathematical terms?

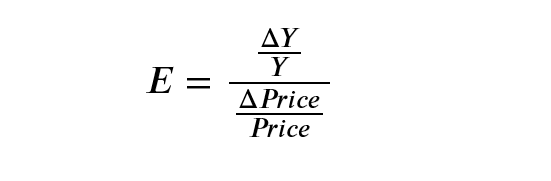

Well, price elasticity is the percentage change of an economic outcome of interest in response to a 1% change in the respective price. Usually that economic outcome of interest is the number of units sold.

Let us denote the economic outcome of interest with Y, and price with P. Then, the price elasticity of the Y must reflect the percentage change in Y in response to a 1 percent change in the P.

We can obtain that by taking the percentage change of Y and dividing it by the percentage change in P. Well, the percentage change of Y is the difference between its present and past value, divided by the past value. Similarly, the percentage change of ‘Price’ is the difference between the present and the past price, divided by the past price.

The economic outcome of interest or Y can differ. Therefore, we distinguish between different types of price elasticity.

Which Are the Three Main Types of Price Elasticity?

Imagine you are working for the marketing team of a brand company.

Now, if you wanted to understand your customers’ behavior, there are three main questions you should definitely know how to answer:

- Will a customer buy a product from a particular product category when they enter the shop?

- Which brand is the customer going to choose?

- How many units is the customer going to purchase?

And all three questions boil down to the estimation of the following economic outcomes of interest:

- Purchase probability,

- Probability for brand choice, and

- Purchase quantity.

But can we determine price elasticity for all three outcomes? Sure. We can calculate:

- Price elasticity of purchase probability;

- Price elasticity of probability for brand choice;

- and Price elasticity of purchase quantity.

Keep reading because we’ll explore each of these in more detail and discover the role of data science is in determining price elasticity.

[ufwp id=”2347360″]

How to Calculate Price Elasticity of Purchase Probability Using Data Science?

We know there are probably a lot of different brands with differing prices from the same product category on the market.

Take the price of different brands of beer, for example.

Suppose we can calculate an aggregate price for the whole category. The law of demand says that the greater the price, the lower the quantity that customers want to buy.

So, if the aggregate price increases, the probability of purchasing a beer would decrease.

And calculating price elasticity will show us how much exactly.

But how do we calculate it? Well, this is where data science comes into play.

Based on existing purchase data, we can create a logistic regression model and predict how likely it is for a customer to decide to buy a product. Then the elasticity of purchase probability can be calculated.

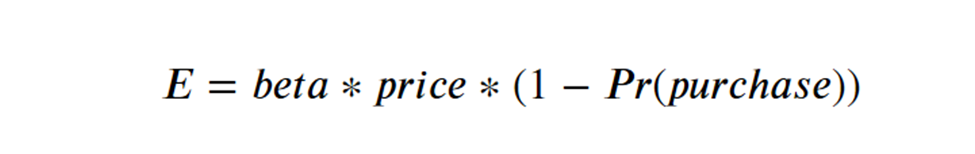

So, the equation for price elasticity is the beta coefficient for price multiplied by price, multiplied by 1 minus the purchase probability.

[ufwp id=”1507748″]

What About Using Data Science to Calculate Price Elasticity of Probability for Brand Choice?

Well, that’s the most interesting case. And it’s the most important for marketers, as well.

If you’re working for Oreo, you’d be interested in the Oreo brand, not in the aggregate biscuits’ sales across the board. That’s why all marketer’s efforts are devoted to influencing customers to choose namely their brand over competing brands.

You see my point, right?

Similar to purchase probability, we can assume that if the price of a product from a given brand increases, the brand choice probability for that brand decreases. Again, calculating price elasticity of brand choice for a brand with respect to the price of that brand would show us exactly how much.

Therefore, if another brand increases its unit price, the brand choice probability of the brand of interest would increase. I know what you’re thinking – this is precisely the Coca-Cola – Pepsi example we started with. Such elasticity calculations will show us how much the brand choice probability of our brand would increase with a one percent increase in the price of a competing brand.

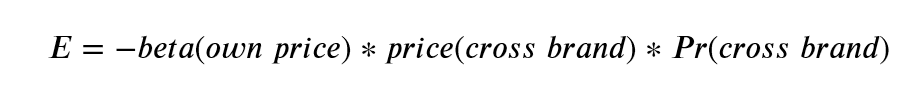

The cross-price elasticity is defined as negative the own brand coefficient times the price range for the alternative brand times the purchase probability for the alternative brand.

And, once again, we can calculate the purchase probability for the alternative brand with the help of a logistic regression.

That’s a nice skill to have, isn’t it?

Now we’ve come to the last case (and you don’t want to miss this next part): determining how many units a customer is going to buy.

What Is Price Elasticity of Demand?

As you might expect, following the law of demand, the greater the unit price of a product, the lower the quantity that is going to be purchased.

For a car, the difference may be from 1 to 0.

So, if the price of a Tesla is acceptable to us, we will buy 1 unit. If it isn’t, we won’t buy any. Alternatively, if we’re considering, let’s say, avocados, depending on the avocado price, we may decide to buy 0, 1, or even 10 avocados at once. And calculating the price elasticities will show us exactly how the purchase quantities move with the change in price.

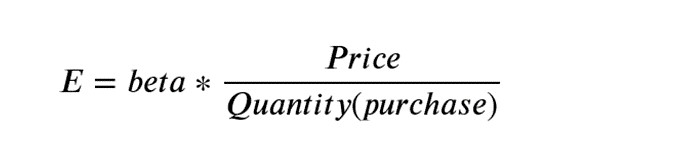

We can calculate probability of purchase quantity with the help of a linear regression model. Then, using the obtained probabilities, we can determine the price elasticities as:

The beta coefficient for price times Price divided by the purchase quantity. Here’s how it looks:

Some final words…

Price Elasticity is a key factor in marketing and customer analytics. And although this article is a great starting point, we’ve only scratched the surface. Price elasticities have a variety of applications in understanding customer data and the purchase behavior of clients. And knowledge in the field of Customer Analytics will be an advantage for any business analyst… As well as data scientists, working in a business-related area.

[ufwp id=”1507748″]

Curious to learn more? Check out the 365 Customer Analytics Course in our Data Science Training. If you still aren’t sure you want to turn your interest in data science into a career path, we also offer a free preview version of the Data Science Program. You’ll receive 12 hours of beginner to advanced content for free. It’s a great way to see if the program is right for you.

for more on data science check here

[ufwp search=”price elasticity” items=”3″ template=”grid” grid=”3″]

Agile project management Artificial Intelligence aws blockchain cloud computing coding interview coding interviews Collaboration Coursera css cybersecurity cyber threats data analysis data breaches data science data visualization devops django docker excel flask hacking html It Certification java javascript ketan kk Kubernetes machine learning mongoDB Network & Security network protocol nodejs online courses online learning Operating Systems Other It & Software pen testing python Software Engineering Terraform Udemy courses VLAN web development